Property Taxation FAQs

WHO DETERMINES THE ASSESSED VALUE OF PROPERTIES IN MANITOBA?

The Province of Manitoba, through Assessment Services, is responsible for all real and personal property assessments in the province, excluding property in the City of Winnipeg.

HOW ARE ASSESSMENTS DETERMINED?

In Manitoba, property is assessed at market value. Market value is the most probable selling price of the property. Regular reassessments are done every 2 years to ensure that property assessments keep pace with real estate market conditions.

Assessment notices are prepared by Provincial Assessment Services in the fall of each year for the following taxation year. The values are based on market values from 2 years prior.

On new construction, Assessment Services may physically inspect the property. If buildings are removed a demolition permit should be obtained from the Portage la Prairie Planning District (at no charge) and the assessment branch will be notified in order to remove this assessment.

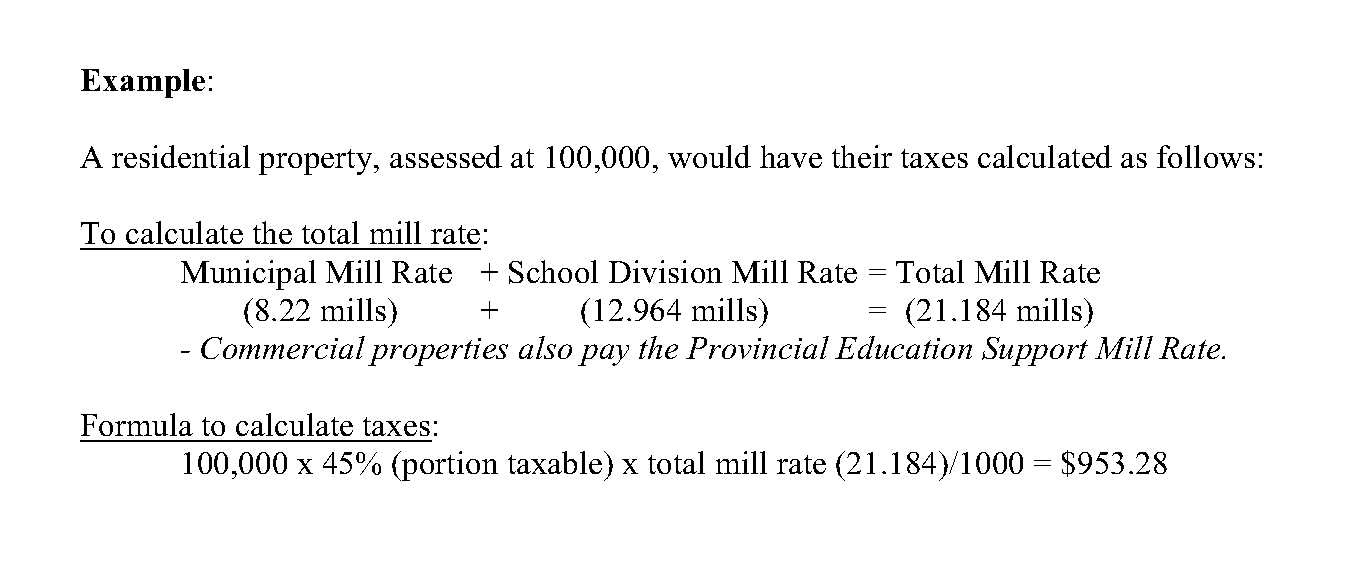

WHAT IS A MILL RATE?

Property taxes are calculated by applying municipal and school mill rates against the portioned assessment of your property. By definition, a mill is a one-thousandth part. For calculating taxes, one mill represents $1.00 of taxes for every $1,000.00 of portioned assessment. The municipal tax rate (mill rate) is based on the budgeted amount of tax dollars the municipality requires to meet its obligations in the current year. The total tax dollar requirement is spread over the entire assessment base for the RM.

HOW DO I CALCULATE MY TAXES?

DOES ALL THE MONEY COLLECTED BY THE MUNICIPALITY STAY WITHIN THE MUNICIPALITY?

No, the property taxes collected are comprised of municipal taxes and school taxes. The municipal taxes are collected for the municipal operations. School taxes are collected by the municipality on behalf of the school divisions and forwarded on to the various school divisions Your tax statement shows the breakdown between municipal and school taxes.

HOW DOES THE MUNICIPALITY DETERMINE THE TAX REQUIREMENT?

Annually the municipality goes through a budgeting process. All areas of the budget are reviewed to determine the needs for the upcoming year. Increases have to be accounted for, new initiatives, cost of living, etc., as well as reducing expenses to offset the increases if possible. The municipality knows the importance of being fiscally responsible with taxation while still maintaining or increasing services. This is a challenge that is faced annually. The municipality holds a public meeting annually to discuss the budget. The public is encouraged to attend this meeting as it is important to be able to express any concerns you may have or to ask questions. The date of this meeting is advertised in the local paper as well as on our website. www.rmofportage.ca